Refine Results

Tip

Personal loans can be a great way to finance a large purchase or consolidate debt. You can compare lenders below to find your best deal.

Must Reads

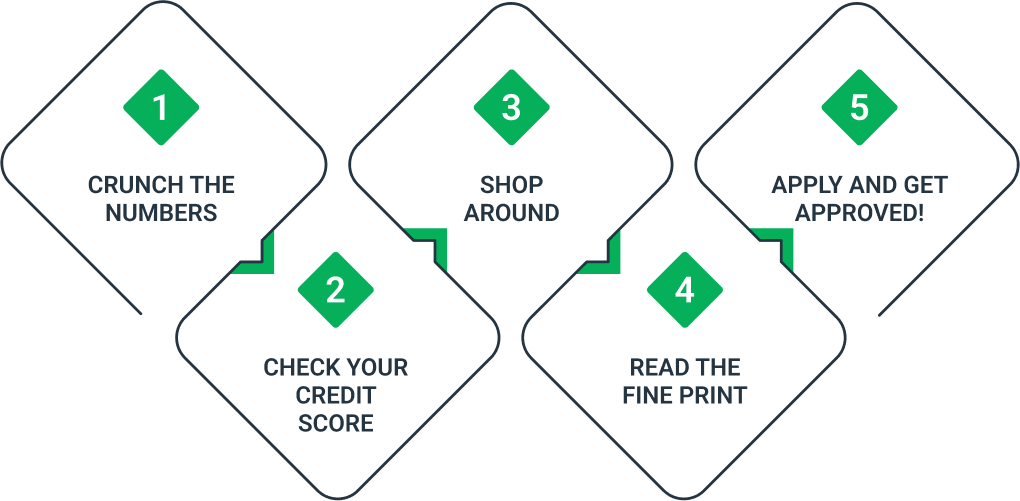

How to get a personal loan in 5 steps

Our goal is to ensure that you have all the information you need to make an informed decision about which provider to choose.

We believe that an educated consumer is our best customer, and we're committed to providing you with the resources you need to make the best decision for your needs.

1. Crunch the Numbers

Before initiating the steps for applying for a personal loan, borrowers should determine how much they need, and how much they can afford to pay on a monthly basis. Be sure to calculate appropriately and borrow enough to get what you need after lender fees are deducted. This can be done by creating a budget and putting together an estimated list of their income and expenses. This way, helped some borrowers determine whether they can afford the loan so they can avoid defaulting on it.

2. Check Your Credit Score

When it comes to how to get approved for a personal loan, a borrower’s credit score usually plays a large role in whether they’re approved. A borrower’s credit score may also determine what kind of interest rates they receive—the higher the credit score, the lower the rates. Credit scores are tracked by three credit bureaus: Equifax, Experian, and TransUnion.

3. Shop Around

It’s important for borrowers to do their research and compare personal loan rates before agreeing to sign with a lender. Many lenders offer prequalification, or soft credit checks, and borrowers can use these estimates to compare interest rates. Other items borrowers should compare between lenders are repayment terms, amounts, fees, and the minimum credit required. These factors may determine whether or not a borrower can take on a loan.

4. Read the Fine Print

Even if borrowers feel comfortable going with a particular lender, it’s still important to read the fine print on any loan that is offered. Consumers don’t want to overlook any specifics that could come back and impact them financially down the road.

5. Apply and get approved!

If a borrower is approved for a personal loan with a lender, they’ll be required to submit a hard credit check before signing and officially accepting the loan. The time it takes to receive a loan entirely depends on the lender. While some lenders offer same-day funding, it may take several business days for other lenders to deposit the money.

FAQ’s About Personal Loans

What is a personal loan?

What do I need in order to apply for a personal loan?

What does APR Mean?

How long does it take to apply for and receive a loan?

Can I get a personal loan online?

How long do I have to repay the loan?

What is a good interest rate on a personal loan?

Personal loans are illustrated by the following example

This site is a free online resource that strives to offer helpful content and comparison features to our visitors. We accept advertising compensation from companies that appear on this site, which impacts the location and order in which brands (and/or their products) are presented, and also impacts the score that is assigned to it. Company listings on this page DO NOT imply endorsement. We do not feature all providers on the market. Except as expressly set forth in our Terms of Use, all representations and warranties regarding the information presented on this page are disclaimed. The information, including prices, which appears on this site is subject to change at any time.

DO NOT SELL MY PERSONAL INFORMATION

The California Consumer Privacy Act (CCPA), gives residents of the state of California the right to prevent businesses from selling their personal information. bestmoney.com takes your privacy very seriously. We support the CCPA by allowing California residents to opt-out of any future sale of their personal information. If you would like to record your preference that bestmoney.com will not sell your data, please check the box below. Please note, your choices will only apply to the browser you are using to submit this form. This also means that if you clear browser cookies, you will need to opt-out again.